The Westfleet Insider:

2020 Litigation Finance Market Report

2nd Annual Litigation Finance Report Finds Continued Industry Growth, Challenges in Unique Year

In 2019, we conceptualized The Westfleet Insider: Litigation Finance Market Report as a comprehensive, transparent informational resource on the size, growth, opportunities, and challenges of the litigation finance industry. The response to our 2019 report was overwhelmingly positive, and so we are back at it again, bringing you the 2nd annual edition of The Westfleet Insider.

The past year was a uniquely challenging one, with the entire legal industry impacted. Accordingly, reading the raw data on the 2020 litigation finance market may not tell the complete story. Nevertheless, some high-level conclusions are immediately clear. To start, the industry is growing. The number of litigation finance providers, their assets under management (AUM), and the dollars they deployed to active financing deals all moved in a positive direction last year.

But many questions remain. Where would the numbers have been in the absence of a global pandemic? Why did we see a shift away from portfolio funding deals and towards single-case financings? And what do some of the new, richer metrics that we tracked this year for the first time tell us?

We explore these questions and many others in our 2020 Litigation Finance Market Report.

Litigation Finance Assets Under Management Grow 18% in 2020

The number of litigation funders active in the U.S. market grew from 41 in 2019 to 46 in 2020. Those 46 funders had combined assets under management (AUM) of $11.3 billion, up $1.7 billion – more than 18% – from 2019.

Funders Execute $2.47 Billion in U.S. Transactions

The number of litigation funders active in the U.S. market grew from 41 in 2019 to 46 in 2020. Those 46 funders had combined assets under management (AUM) of $11.3 billion, up $1.7 billion – more than 18% – from 2019.

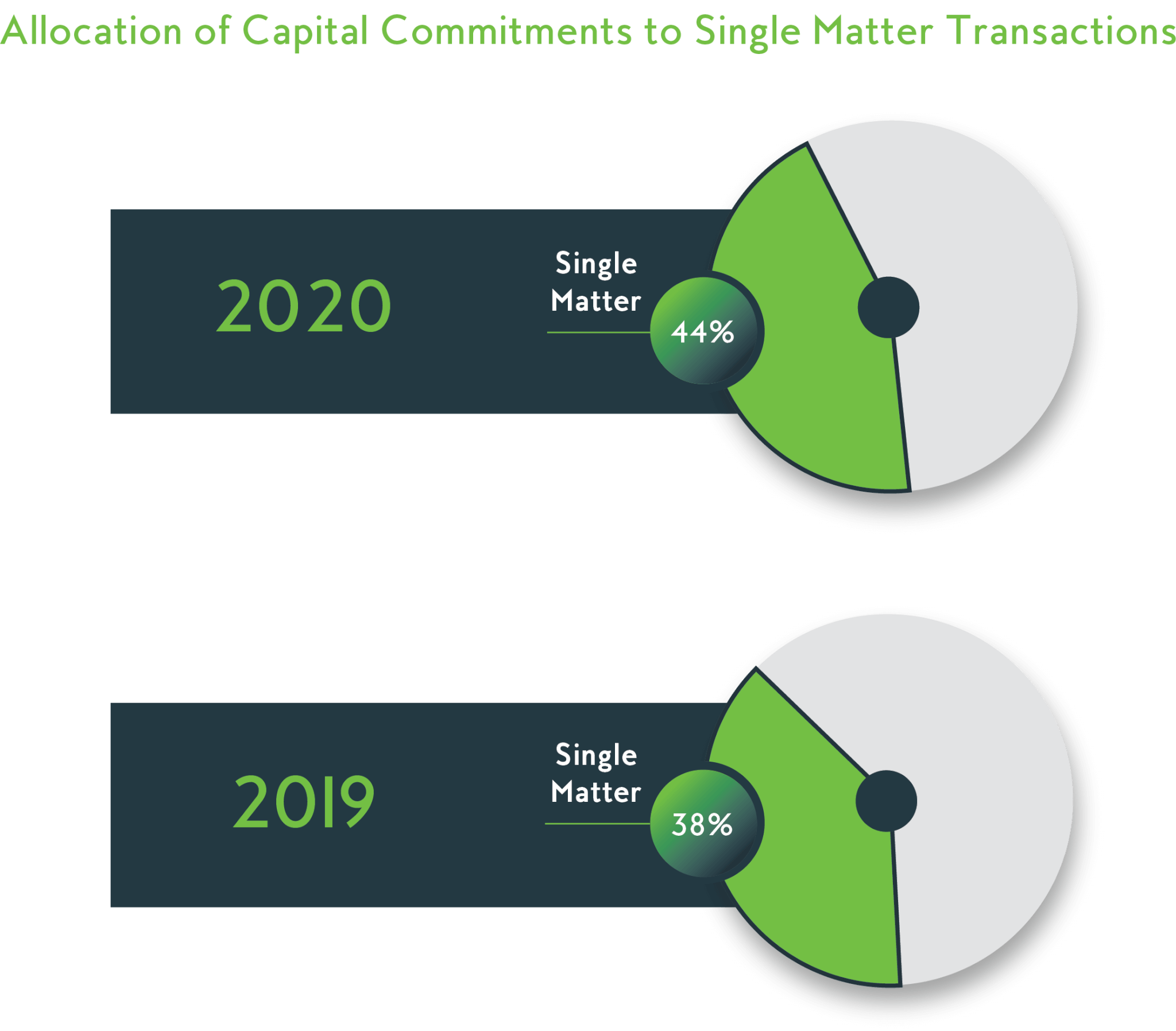

2020 Funding Deals Shift Toward Single-Case Transactions

The funding deals completed in 2020 indicate a slight shift toward single-case transactions and away from portfolio deals. Single matter transactions comprised 44% of all deals in 2020, compared with 38% in 2019. Portfolio structures, on the other hand, declined by 6% in 2020, to 56% from 62%.

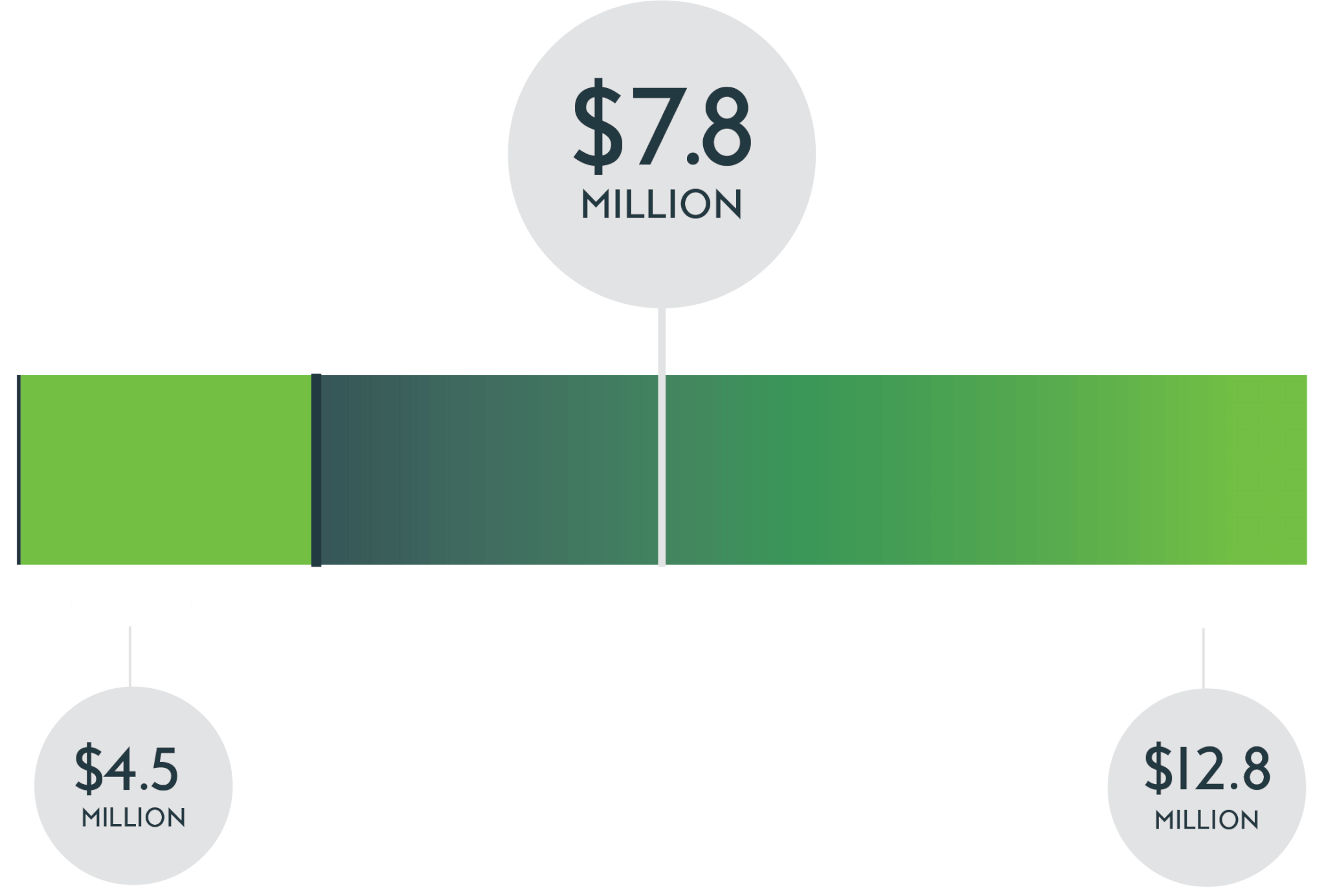

Average Dollar Value of Litigation Funding Transactions Was $7.8 Million in 2020

For 2020, the average dollar value of the transactions we analyzed was $7.8 million. Single matter deals averaged $4.5 million, while portfolio transactions averaged $12.8 million.

THE WESTFLEET INSIDER: 2020 LITIGATION FINANCE MARKET REPORT

Complete the form below to download the report.

2020 Litigation Finance Market Report

MORE WESTFLEET PUBLICATIONS

Westfleet’s publications are designed to provide transparency for potential users of litigation financing.

WESTFLEET IN THE NEWS

“One of our core beliefs is that reasonable industry transparency serves to educate the public and increase comfort with, and ultimately utilization of, litigation finance.”

“A new survey from brokerage firm Westfleet Advisors appears to counter claims made by litigation funders that the pandemic would be a boon for their business and that Big Law firms are major users of third-party financing for suits. ”

“Litigation funders in the U.S. committed $2.47 billion to new funding deals during the 12-month period ending June 2020, a 6% increase from a year earlier, according to litigation finance adviser Westfleet Advisors. ”

“Commercial litigation funding deals saw “tepid” growth amid the COVID-19 pandemic, even as available investor cash continued to balloon and more funders jumped into the market… ”